Our Mission...

We help you mitigate taxes so that what you were paying the IRS can be redirected back to your retirement funds...

What we do...

PROTECT THE NEST EGG

Insulate your business and personal assets from accidents, death, disability, and partnership breakdowns, and friction.

BE TAX NEUTRAL

We implement tax reduction strategies that often lower taxes 40-60% and even as much as 90-100% with some companies.

EXIT PLANNING

Implement an exit strategy to mitigate the 20% capital gains tax. Use correct restructuring techniques.

TAX-FREE RETIREMENT

With the money we often save clients in taxes, we show them how to create a tax-free retirement income stream that lasts a lifetime.

Do our goals align with your goals?

Business Tax Mitigation Tools

Birdseye Financial Training

BUSINESS TAX MITIGATION TEAM

John Dass

513-257-8447

Please text request prior to booking

When booking, be sure to add your name on to the line next to the client and add your email as GUEST EMAIL

REFERRAL PARTNERS

When scheduling with an advanced advisor below, be sure your client is QUALIFIED and commits to meeting so you do not waste the time of the person helping you close business.

Terry Register

CapSur (Team)

919-488-5840

Terry Register

919-349-9319

Amy Brown

- Calendar

- Dial In Calls 719-387-5556

then enter 4883686#

Terry is a master of marketing and has a passion to build the kingdom of God with advisors who want to work as a team.

He has so many marketing tools and sales systems, sales strategies and product knowledge you will be blessed.

_____________________

Business Tax Consultants

Elizabeth Brown, Managing Attorney

877-282-4282 (Main)

865-239-9014 (Direct)

865-564-9442 (Fax)

Pricing Sheet (for clients)

Elizabeth Brown - Business Tax Consultants (Tax Mitigation)

Elizabeth Brown, Managing Attorney

877-282-4282 (Main)

865-239-9014 (Direct)

865-564-9442 (Fax)

Pricing Sheet (for clients)

Robert Tanner Jr.

(Tax Mitigation)

504-382-8088

Make sure your client is qualified before you book.

WHAT IS REQUIRED

- Pre-Appointment Questionnaire

PROCESS

- Schedule Meeting (Link)

(Add your name and email)

- Fill in Fact Finder (Link)

(Print your own PDF copy)

- Email Meeting notes (use questions on the Referral Script (to Robert)

- Attend meeting (introduce client to Robert and Robert to the client)

RESOURCES

Robert D. Tanner, Jr.

Founder and CEO, Integrity Financial Business & Corporate Services

(844) 993-3080

(504) 382-8088

theintegrityplan.com

3500 N Hullen Street,

Metairie, LA 70002

Operates out of six offices:

- 3500 N Hullen Street Metairie (Main Office)

- 2900 Poydras Street NOLA

- 1010 Common Street NOLA

- 8550 United Plaza Baton Rouge

- 345 Doucet Road Lafayette

- 111 Oak Street Hammond

Herbert Financial (Tax Mitigation)

Herbert Financial

818-213-1388

Monrovia

635 W Foothill Blvd

Monrovia, CA 91016

Orange County

17452 Irvine Blvd

Tustin, CA 92780

TAX SERVICES

Proactive, legal tax reduction

Flexible 1031 alternative

DeFi and staking compliance

Recover missed R&D refunds

High-Net-Worth Individual Planning

Tax-smart wealth preservation

We handle the IRS

Accelerate property depreciation

Clean books, every month

IRS Tax Resolution Services

Financial Advisor Orange County

Precision in Every Return

Navigate Your Future with Clarity

Strategic Tax Planning for Local Growth

Navigate tax season with local expertise

BUSINESS SERVICES

Cash flow, KPIs, clarity

Data-driven expansion plans

Protect against owner disability

Rolling 12-month forecasts

Entity Structuring (LLC/S Corp)

Minimize self-employment taxes

Disability Insurance

Income protection, tax-smart

FATCA & FBAR compliance

Safeguard business and family

Keep capital working

Protect critical leadership

Tax-advantaged risk funding

Tax-efficient benefit design

Michael Clanin

(Specialized Trust)

Sales Training

Training makes us better...

(Online Sales Training)

CLIENT SCIRPT

OPENING

Hello (Client),

Thank you for taking the time to speak with me about your business.

ASK QUESTON

Before we get started, I am curious about our text messaging. We mentioned using tax reduction strategies to save 40-60% in taxes on average.

What about what we do caught your attention?

Emotional Hook (Go down three levels for emotion)

Why is that important to you?

Connect the Hook

If we could help you achieve (GOAL) by reducing your current taxes by 40-60%, how valuable would that be to you?

Business Details

Many of the strategies are based on how a business is structured and operates.

Can you share about your business?

Are you set up as an S-Corp?

How many Employees do you have?

How much revenue did you generate last year?

How much in taxes have you paid this last year?

Are you funding a company plan like a 401K or SEP IRA to offset your taxes?

(If Yes) Are you max-funding the plan?

(If Yes) Have you considered a ROTH Conversion strategy?

The concept works great when your fund is over $500,000.

MAIN HOOKS

MITAGATE TAXES

What are you currently doing to lower your taxable income by 40-60% now?

We believe that one person does not know everything. Would you agree? (YES)

Who do you have on your tax team now? (CPA)

CPAs often focus on compliance, helping you file taxes, your quarterlies, your accounting, Payroll, and things like that, which makes it hard for them to master the tax codes.

So we have a team of Business and Tax Strategists, Tax Attorneys, and Enrolled Agents that work together to design a tax plan.

How often does your CPA, Attorney, and Financial Advisor speak to each other? (Never)

I would like to introduce you to my team and have you meet with (ADVISOR NAME), who will help you this year mitigate over 40-60% of your taxable income, if not more.

COMMERCIAL PROPERTY (Cost Segregation)

Do you own commercial property valued over $1 million?

Did you know most CPA's will depreciate properties using a 39 year schedule?

We help you accelerate depreciation so you can:

Create more up-front cash flow

Lowering your taxes both now and in the future

Recapture past depreciation from the last few years.

If we increased your cash flow, how valuable would this be for the business and even for funding your retirement?

SELLING YOUR BUSINESS

When do you plan to sell your business?

We show business owners how to

Get the best valuation

Use the QSBS $15 million business tax exemption

Avoid the 20% capital gains tax

If you got 20% more income and use that money in retirement, how valuable would that be for you and your family?

LEARN TO LEVERAGE INCOME (Premium Finance)

In retirement, how are you planning to create your income?

We show business owners how to leverage other people's money to fund their retirement income tax-free.

How Valuable would that be?

We often double or triple your income

GROWING A BUSINESS

PROTECT YOUR BUSINESS

Key Person

Key person insurance is a life or disability insurance policy taken out by a business on a crucial employee, such as a founder, owner, or highly specialized individual, to protect against financial losses resulting from that person's death or prolonged illness.

The policy's payout helps the business cover costs like lost revenue, operational disruptions, recruiting and training a replacement, and paying off debts, ensuring the company can continue to operate smoothly despite the loss of their most valuable asset

Split-Dollar

Split-dollar life insurance is an arrangement between an employer and employee where they share the costs and benefits of a life insurance policy, with the employer often paying the premiums and receiving either a portion of the death benefit or reimbursement of those costs from the policy's cash value or death benefit.

This can provide employees with affordable access to substantial life insurance coverage for their families and offer employers a strategy to attract, motivate, and retain key employees.

The specific structure and tax consequences depend on the chosen split-dollar method, either the "economic benefit" or the "loan" regime.

You write the policy

Buy-Sell Funding

Buy-sell funding refers to the plan for providing the necessary cash to fulfill a buy-sell agreement, which is a contract that outlines how a business owner's share will be transferred if they die, become disabled, or retire. Funding ensures that the business or remaining partners can purchase the departing owner's interest, maintaining business continuity.

Life insurance is a common method, providing immediate, tax-free funds upon an owner's death, while other options include internal financing from business savings or external financing like bank loans.

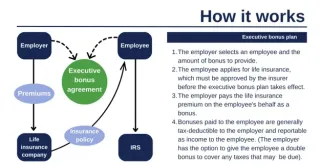

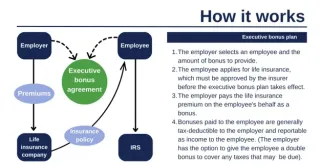

Executive Bonus

An executive bonus, specifically a Section 162 executive bonus plan, is a compensation strategy where a company provides a key executive or business owner with a cash bonus that is used to pay for a personal life insurance policy.

The company receives a tax deduction for the bonus, while the employee is responsible for the income tax on the bonus amount.

The executive owns the life insurance policy, benefiting from its death benefit and potential cash value.

You write the policy

SEE MORE UNDER TERMS (BELOW)

Disability Coverage

Who pays the bills if you get sick or injured at home or on the job?

Disability insurance is a type of insurance that replaces a portion of your income if you become unable to work due to an illness, injury, or other medical condition.

It comes in two main forms: short-term disability (STD), which provides benefits for a limited time, and long-term disability (LTD), which provides benefits for extended periods, potentially for life.

You write the policy

BOE (Overhead Exp)

Business Overhead Expense (BOE) Insurance is a type of disability insurance that helps small business owners cover fixed business operating costs, such as rent, utilities, payroll, and loan interest, if they become disabled and can't work for a period of time.

This policy is designed to prevent a temporary disability from forcing the closure of a business by ensuring that ongoing expenses are paid until the owner can return or make alternative arrangements

You Write the policy

INCREASE CASH FLOW

Cost Segregation

If we could accelerate your property depreciation schedule from 39 years to 5, 7, & 15 year and put a good deal of money in your pocket how valuable would that be? (MORE INFO)

ESOP (Employee Stock Option Plan)

An Employee Stock Ownership Plan (ESOP) is a retirement plan that allows employees to become partial owners of their company by holding shares of company stock.

An ESOP trust holds these shares on behalf of employees, creating a retirement benefit that incentivizes productivity and retention by aligning employee and company interests.

For business owners, an ESOP offers a tax-friendly way to sell their business and transition out.

Non-Qualified Deferred Compensation Plan

A non-qualified deferred compensation (NQDC) plan is a contractual agreement between an employer and an executive or highly compensated employee to pay a portion of their salary, bonus, or other compensation at a future date. Unlike a standard 401(k), NQDC plans allow high earners to defer more income than the IRS-imposed limits on qualified plans, providing an additional tax-advantaged savings opportunity.

Cash Balance Plan

A defined Benefit Retirement Plan where Pay Credits and Interest credits made by employer are tax-deductible and tax deferred for the employee. (MORE INFO)

Cost Reduction with a Health Plan Analysis

Health plan analysis uses data to evaluate and improve health insurance plans by examining cost, quality, member experience, and market trends.

This process involves analyzing claims data, member health information, provider networks, and policy impacts to identify patterns, reduce costs, and enhance care quality for members.

Key areas of focus include coverage scope, network providers, plan benefits, member satisfaction, and overall plan performance through standardized surveys.

Review 401K Plan

Review your 401(k) plan to ensure your offering those on the program the right options and that your matching and costs are competitive.

(MORE INFO)

Cost Reduction on P&C, GL, and WC

Most employers over pay the interest rate on the financing of:

- Property & Casualty

- General Lines

- Workers Comp

We can offer rates much lower then the double digits most carriers are charging.

Also get a quote for better potential pricing.

Planning for Retirement

Retirement Software

We create a Retirement Plan at no cost. This software will illustrate what your retirement may look like and what changes you can make now to have a huge impact. (MORE INFO)

- RETIREMENT ANALYZER SOFTWARE

Income Planning

Income planning is the process of creating a strategic financial plan to ensure a steady and sufficient income stream to meet financial needs throughout different life stages, particularly in retirement.

It involves analyzing potential income sources (like Social Security, pensions, and investments), estimating future expenses, and determining the optimal timing and method for converting savings into a reliable income to cover living costs and avoid running out of money.

Selling Your Business

We help business owners get:

- Correct Valuation

- Increased Valuation

- $15 Million Exemption

- Eliminate the 20% in Capital Gains

Market Risk Investment

Get access to a team of fiduciary advisors that offers you both active and passive investment options.

Using the platform of Schwab, and the expertise of our portfolio management team you will get the type of support you need to grow your funds.

All investments are managed by Simplicity Wealth of San Diego.

ROTH Conversions

Learn how much money you could save by converting Pre-Tax Dollars to Post Tax Dollars.

Pay on the Seed vs the Harvest

(MORE INFO)

Pension Max Option

Pension maximization is a retirement strategy where an individual chooses the highest possible monthly pension payout (a single-life annuity) and uses the difference in income to purchase a life insurance policy for their spouse.

This allows the couple to enjoy a higher income during the pensioner's lifetime, while the life insurance policy provides a death benefit to replace the lost pension income for the spouse after the pensioner dies.

Premium Finance

If we could help you leverage other peoples money to double and often triple your retirement income tax-free, how valuable would this be?

(MORE INFO)

Estate Planning

Estate planning is the process of arranging for the management and distribution of your assets and affairs during your lifetime and after your death, ensuring that your property and wealth go to the people and causes you choose.

Key components include wills, trusts, and powers of attorney to direct how assets are transferred, manage your care if you become incapacitated, and name guardians for minor children.

Advisor Training

Agent Resources

Annuity Training

Seminar Training

STRATEGY DETAILS

Key Person

Life Insurance

The Pitch

If your business could be paid should your most KEY PERSON in the company die, how valuable would that be to you?

What is it

A business plan designed to mitigate the risks associated with the loss of a crucial employee through death by evaluating the potential impact of losing these individuals, including financial losses, operational disruptions, and reputational damage.

How it Works

Under a key person life insurance policy, the business owns the policy, pays the premiums, and is the beneficiary. If a key person dies, the company then collects a death benefit. That money can be used to help a business replace lost revenue as it searches for a replacement.

DOCUMENTS NEEDED

Name

Age

Health

State

Policy Type (WL, UL)

Death Benefit

Premium Amount

Next Step

You write a life policy

Advisor Resource

You write the business

Buy-Sell Agreement

Life Insurance

The Pitch

If your business could be paid should your most KEY PERSON in the company die, how valuable would that be to you?

What is it

A buy-sell agreement is a legally binding contract among business owners that sets forth the terms and conditions for buying out a departing owner's share or interest in the business.

How it Works

Life insurance is a vital tool for funding buy-sell agreements as it provides immediate liquidity upon the death of an owner, ensuring a smooth and timely transfer of ownership without disrupting the business's operations.

This helps avoid potential financial hardships for the remaining owners and provides a pre-determined value for the departing owner's shares to their heirs.

DOCUMENTS NEEDED

Name

Age

Health

State

Policy Type (WL, UL)

Death Benefit

Premium Amount

Next Step

You write a life policy

Advisor Resource

You write the business

Cost Segregation

Fee-Based Service

The Pitch

If we could accelerate your depreciation schedule from 39 years to a 5, 7, and 15 year schedule on commercial property, resulting in more money back in your pocket, how valuable would that be to boost Cash Flow and reduce taxable income?

What is it

Cost segregation is a tax strategy that helps real estate investors save money by accelerating depreciation on parts of their properties. When you buy, build, or renovate a building. Whether it’s a house, office, or store, you can claim tax deductions based on the value of the property over time. Normally, buildings are depreciated over a long period, such as 27.5 years for residential properties and 39 years for commercial ones. But with cost segregation, you can speed up these deductions.

Benefits

Accelerated Depreciation

Increased Cash Flow

Enhanced Return on Investment (ROI)

Potential for Look-Back Studies

How it Works

First, submit the Depreciation Schedule and address for review

Receive an OFFER LETTER with fee disclosure

Once accepted and the fee is paid, the work will begin

Step-by-Step Process

1) Initial Consultation

2) In-Person / Virtual Site Visit

3) Asset Classification

4) Cost Allocation

5) Final Report

6) Review

DOCUMENTS NEEDED

Last years depreciation schedule

Property Address

Details (Value vs Debt)

Next Step

Book appointment with Tax Strategist listed

Any amount over $1 Million

Eric - Only property valued over $5 Million

Additional Notes

Compensation: 30% of the FEE?

Advisor Resource

"Private Letter Ruling from the IRS Chief Counselors Office" (Golden Ticket)

Premium Finance

Life Insurance

The Pitch

If we could show you how to leverage other people's money to double and often triple your retirement income tax-free, how valuable would that be?

What is it

Premium finance is a specialized lending strategy that allows individuals and businesses to finance the cost of insurance premiums through a bank loan from a third-party lender, rather than paying out of pocket. The owner will pay interest payments but gain tax-free income later on in the policy.

How it Works

First, submit the Depreciation Schedule and address for review

Receive an OFFER LETTER with fee disclosure

Once accepted and the fee is paid, the work will begin

OUR PROCESS

First, we create a Retirement Analysis of your current scenario (Retirement Analyzer)

Next, we review the huge impact of a leveraging strategy in your portfolio

Review the details of how this strategy works with a leveraging expert

Complete all applications to implement the strategy

DOCUMENTS NEEDED

Start Retirement Analyzer Sofware

For the Specialist

Fact Finder

Personal Financial Statement

Profit and Loss

For Loan application

Last two years tax returns

Next Step

When ready, book appointment with Tax Strategist listed

Additional Notes

Commission is 70-80%

Specialist cost is 25%

Advisor Resource

- Robert Tanner

- Terry Register

- UFC 727-543-1220

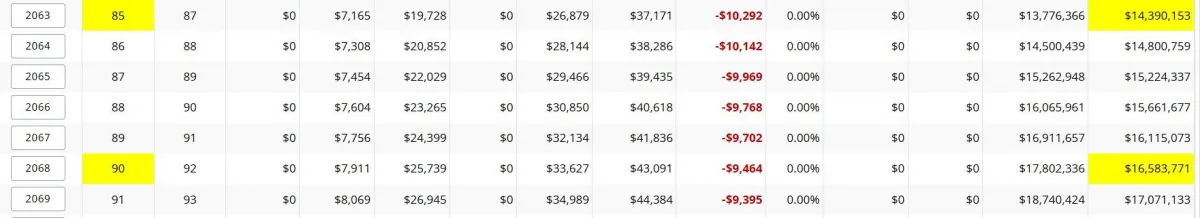

Illustate Premium Finance using Retirement Analzyer (SAMPLE)

WITHOUT Premium Finance

With Premium Finance

How to Setup Premium Finance

HOW TO SET UP THE RETIREMENT ANALYZER SOFTWARE

Copy the Scenario (at the bottom right) and rename Legacy Strategy, and open both scenarios in two separate tabs

On New Legacy Strategy Scenario (create the following)

TAB #2 - Create a Future Sell the Business (Zero Balance)

TAB #2 - Create a Future Tax-Free Income Acct (Zero Balance)

TAB #2 - Set up the Withdrawal Order

Future Tax-Free Income

Future Business Valuation

HOW TO SET UP CASH FLOW ACCOUNTS (Tab 4)

Line #1 - Sell the business - Inflow of what the value will be in the year the business may be sold

(Example, above, in 2026, the business value is $6.4 million, software will show you)

Line #2 - PF Funding - Outflow comes from any source (IRA, Brokerage, etc) and goes into External PF PLAN (Loan Interest Payments)

Line #3 - PF Income - Inflow comes from the TAX-FREE External Source and flows into the Tax-Free Income account (Income)

Line #4 - PF Legacy Benefit - Inflow comes from the TAX-FREE External Source and flows into the Tax-Free Income account (Death Benefit / Legacy)

Retirement Analyzer

Software

The Pitch

Just like with a doctor who uses an X-ray to help you with your health, we create a retirement analysis that can show us many tax strategies and other important planning strategies for your retirement outlook.

What is it

An easy-to-use retirement planning software that can help analyze retirement planning scenarios and elements of retirement planning.

Benefits

Income Planning (Social Security, Pension, Cash Flow)

Risk Analysis (Risk Money vs Safe Money)

Portfolio Projection (Growth, Inflation, taxes, expenses)

Tax Strategies (ROTH Conversion)

Life Analysis (If someone dies too soon, survivor outcome)

Long-Term Care (If you are one of the 70% who need care)

Client Login (You have complete access and the ability to change data)

OUR PROCESS

First, we create a Retirement Analysis of your current scenario (Retirement Analyzer)

We look at Income, Assets, Expenses, and Taxes

Within 30 minutes, you will find out if you can apply a TAX-FREE strategy

You will also see what your estate will look like throughout retirement

DOCUMENTS NEEDED

NOT REQUIRED BUT GOOD TO HAVE FROM CLIENT

Social Security Statement

Pension Letter

Investment Statements

Next Step

Send Retirement Analyzer Software LINK or Send Fact Finder to the client

Additional Notes

Creative One offers this software for no cost.

Reach out to:

Creative One

John Heim

(913) 402-2137

Advisor Resource

Retirement Analyzer

(800) 854-6621

Website

FREE TRIAL

https://www.retirementanalyzer.com/register/individual?watched=true

(Open in browser) and Video Notes

Selling Your Business

Fee-Based Service

The Pitch

How valuable would it be if our team could accomplish

- Exit Planning (Sell to others)

- Succession Planning (Sell to family)

FOUR KEY BENEFITS

Correct Valuation (Get the right value, not a lowball price)

Increased Valuation (What can be done to build value)

$15 Million Exemption (must be 5 years in advance or it's prorated starting year 3)

Eliminate Capital Gains (Eliminate or reduce the 20% capital Gains tax)

OUR PROCESS

Schedule a meeting with our Exit Planning Team

DOCUMENTS NEEDED

NONE AT THIS TIME

Next Step

Book appointment with Tax Strategist listed

Additional Notes

Split fee compensation

Amount is unknown

Advisor Resource

Industry Terms

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

is a financial metric used to measure a company's operating profitability and operational efficiency by excluding non-cash expenses, financing costs, and taxes. By adding back interest, taxes, depreciation, and amortization to a company's net income, EBITDA provides a clearer view of its core earnings potential, making it useful for comparing businesses within the same industry and assessing a company's ability to generate cash from its operations

Section 199A - QBI (Qualified Business Income)

The Qualified Business Income (QBI) deduction, or Section 199A, allows eligible owners of pass-through businesses to deduct up to 20% of their net business income on their taxes. This can significantly lower a taxpayer's effective tax rate and is available even if you take the standard deduction. (USE FORM 8995)

The deduction is available to owners of:

- Sole proprietorships

- Partnerships

- S-Corporations

- Some trusts and estates

The QBI deduction was made permanent by the One Big Beautiful Bill (OBBBA), removing the original expiration date of 2025.

What qualifies as QBI

To qualify, the income must be from a trade or business in the United States and meet the definition of "qualified business income". It generally includes net profit, but specifically excludes:

- W-2 wages

- Capital gains or losses

- Investment income (including certain dividends and interest)

- Guaranteed payments made to partners

- Income earned outside the United States

Section 1202 - QSBS (Qualified Small Business Stock)

Key requirements for QSBS

Direct acquisition:

The stock must be acquired directly from the issuing company at its "original issuance" in exchange for cash, property, or services.

Company asset limits:

At the time of issuance, the issuing corporation's aggregate gross assets must not have exceeded $50 million (or $75 million for stock issued after July 4, 2025).

Active business requirement:

For substantially all of the holding period, the issuing corporation must meet the "active business" requirements, with at least 80% of its assets being used in a qualified trade or business.

Holding period:

The stock must be held for more than five years to qualify for the full exclusion.

Exclusion limits and benefits

For stock issued before July 5, 2025:

The exclusion is the greater of $10 million or 10 times the taxpayer's adjusted basis in the stock.

For stock issued on or after July 5, 2025:

A tiered exclusion applies, based on the holding period: 3-4 years: 50% exclusion 4-5 years: 75% exclusion 5+ years: 100% exclusion

The exclusion cap is increased to the greater of $15 million or 10 times the taxpayer's adjusted basis in the stock.

Ineligible businesses

Certain businesses are ineligible, such as those in financial services, law, accounting, health, architecture, and natural resources.

BPT (Business Privilege Tax)

A business privilege tax is a tax imposed by a state or local government on businesses for the right to operate within its jurisdiction. These taxes help fund local public services and infrastructure, such as police and fire protection, road maintenance, and waste management.

How it works

The specifics of a business privilege tax vary by location and type of business, but the tax is generally calculated in one of several ways:

- Based on gross receipts: Some taxes are a percentage of the business's total revenue.

- Based on net income: The tax can be based on the business's profits.

- A flat fee: Some jurisdictions impose a set fee on all businesses or specific types of businesses.

BPT (Business Profits Tax)

A business profits tax is a state-level tax on a business's net income (profits) earned from activities within that state. Tax base: This tax is based on net income, which is a business's revenue after subtracting allowable expenses and deductions.

Section 162 (Executive Bonus)

A Section 162 executive bonus plan allows a company to pay a tax-deductible bonus to an executive to fund a life insurance policy or annuity that the executive owns, providing them with a death benefit and a tax-deferred, accessible cash value over time.

For the company, the bonus is an "ordinary and necessary" expense and therefore a deduction, while the executive receives the policy benefit. These plans are simple, flexible, and effective for retaining and recruiting key employees by offering benefits not subject to Section 409A rules.

Benefits for the Company

- Retention and Recruitment: The bonus plan helps attract and keep valuable employees.

- Simplicity: Plans are straightforward to administer compared to other executive benefits.

- Cost-Effective: It's an affordable strategy for companies without extensive budgets for elaborate packages.

- Flexibility: The company can adjust or stop bonus payments in the future.

How it Works

1. Bonus Payment:

The company makes bonus payments to the executive.

2. Policy Ownership:

The executive uses the bonus money to purchase and personally own a life insurance policy or annuity.

3. Tax Treatment:

- Company: The bonus payment is a deductible business expense.

- Executive: The bonus is taxable income to the executive, who can also receive the policy's cash value tax-deferred and potentially tax-free.

4. Flexibility:

The executive can use the cash value later for retirement or other goals, often without penalty.

Benefits for the Executive

- Portability:

The executive owns the policy, making it a portable asset even if they change employers.

- Tax-Deferred Growth:

The cash value grows on a tax-deferred basis.

- Access to Funds:

The executive can access the cash value for personal needs, such as retirement income.

- No 59½ Penalty:

Distributions from the policy are not subject to the 10% penalty for distributions before age 59½.

Requirements for a business expense

An expense must satisfy six criteria to be deductible under Section 162(a):

- Ordinary: The expense is common and accepted in the taxpayer's specific trade or business.

- Necessary: The expense is appropriate and helpful for the business. It does not have to be indispensable.

- Expense: It must be an expense rather than a capital expenditure for an asset with a longer useful life.

- Paid or incurred: The payment must have been made during the taxable year.

- In carrying on: The expense must be related to an active trade or business, not a mere hobby.

- Trade or business: The activity must be engaged in for profit.

Common deductible expenses

- Advertising and marketing costs

- Salaries and wages paid to employees

- Insurance premiums for the business

- Professional fees, such as legal and accounting services

- Business travel expenses, including lodging and transportation

- Office rent, supplies, and utilities

- Certain taxes and license fees

Key limitations under Section 162

While Section 162 allows for broad deductions, other parts of the code add important limits and exceptions:

- Section 162(m) — Excessive executive compensation:

This provision limits the deduction for compensation paid by publicly held corporations to certain executives to no more than $1 million per year.

- Section 162(e) — Lobbying and political expenditures: Most expenses for lobbying or influencing legislation are not deductible.

- Section 162(f) — Fines and penalties: Fines and penalties paid to a government for violating a law are generally not deductible.

- Section 162(q) — Sexual harassment or abuse payments: This provision disallows deductions for payments related to sexual harassment or abuse that are subject to a nondisclosure agreement.

- Illegal payments: Bribes, kickbacks, and other illegal payments to government officials or others are not deductible.

Section 7702 (Life Insurance)

Section 7702 of the U.S. Internal Revenue Code defines what qualifies as a life insurance contract for federal tax purposes.

Established to prevent investment vehicles from receiving favorable tax treatment as life insurance, it provides two primary tests that a policy must pass to secure tax-advantaged status.

The two qualification tests

1. The Cash Value Accumulation Test (CVAT)

The CVAT is a prospective test requiring that the policy's cash surrender value never exceed the net single premium required to fund its future death benefits.

It ensures the policy maintains a sufficient "amount at risk," meaning the death benefit remains significantly higher than the policy's cash value, upholding its insurance purpose.

The test limits the cash value relative to the death benefit, which can result in more restrictive growth potential compared to the other test, especially over the long term.

2. The Guideline Premium and Corridor Test (GPT)

The GPT consists of two parts: a premium test and a cash value corridor test.

Guideline Premium Test: This part limits the total premiums paid into the policy. It states that the sum of premiums paid cannot exceed the "guideline premium limitation" at any time. This limitation is based on either a guideline single premium or the sum of guideline level premiums.

Cash Value Corridor Test: This part maintains a required gap, or "corridor," between the policy's death benefit and its cash value. As the insured ages, the death benefit must be a certain percentage higher than the cash surrender value. This ensures a sufficient amount of "at-risk" insurance is maintained relative to the accumulating cash value.

Section 179 (Equipment Deduction)

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, rather than depreciating the cost over several years.

The deduction is intended to incentivize businesses to invest in themselves.

Section 179 key details for 2025

Recent legislation, including the "One Big Beautiful Bill Act" (OBBBA), has made significant changes to the Section 179 deduction for 2025.

Maximum deduction: The maximum amount a business can deduct is $2.5 million for the 2025 tax year.

Spending cap: The deduction begins to phase out dollar-for-dollar once a business's total equipment purchases exceed $4 million.

Business income limit: The deduction is limited to the business's net taxable income. Any amount that exceeds this limit can be carried forward to future tax years.

Qualifying property

Most tangible, depreciable personal property purchased for business use qualifies. The asset must be used more than 50% for business purposes. Examples include:

- Machinery, tools, and equipment.

Computers and "off-the-shelf" computer software.

- Office furniture and equipment.

- Certain business vehicles.

- Qualified real property improvements, such as roofs, HVAC systems, fire protection, and security systems on nonresidential buildings.

Non-qualifying property

Some property is specifically excluded from Section 179 deductions:

- Land and land improvements.

- Inventory.

- Office supplies.

- Assets purchased from a related party.

Section 179 versus bonus depreciation

Section 179 and bonus depreciation both offer immediate expensing for business property, but they have some notable differences

Frequently Asked Questions

Why are you finding Tax Savings my CPA has not?

We often find that CPAs focus on Compliance and not on Tax Mitigation Strategies. It's like asking your primary care doctor to be your cardiologist.

A Tax Mitigation team will consist of both Tax, Legal, and Financial advisors who are working together to achieve the maximum results.

Can you work with my CPA on Tax Strategies?

Yes, we will educate your CPA with Advanced Tax Mitigation Strategies that we would use to mitigate your taxes 40-80%.

Our team has Tax, Legal, and Financial advisors designing the strategies as a team approach.

What are your cost for working with my company?

This depends upon the services you have requested. Our Strategy meetings are no cost, but the implementation may carry a cost depending upon the services involved.

The goal of Tax mitigation is to save you 40-80% of the taxes you would pay the IRS, and worth the fees involved to mitigate.

© Business Tax Mitigation