MOST POPULAR SERVICES

Tax Filing Review

Accelerated Depreciation

Accelerated depreciation and reduced tax liability:

By reclassifying components into shorter depreciation periods, taxpayers can claim larger deductions sooner, lowering their taxable income and overall tax burden in the early years of ownership.

Increased Cash Flow

The accelerated depreciation leads to a significant increase in immediate cash flow for property owners.

Estate Planning Benefits

Cost segregation can provide current year deductions for beneficiaries of an estate.

Benefits of QIP

Benefits for Qualified Improvement Property (QIP):

Interior improvements to nonresidential buildings placed in service after the building itself may qualify for shorter depreciation periods and bonus depreciation.

Residual Benefits

Identifying components allows for calculating and deducting the remaining basis when those components are replaced or disposed of.

Flexible tax planning

Even with changes in bonus depreciation rules, reclassifying assets provides flexibility in planning deductions.

Potential state tax incentives

A cost segregation study can help establish the basis for potential state-level tax benefits.

IRS Compliant

Adhering to all tax laws and regulations established by the Internal Revenue Service (IRS).

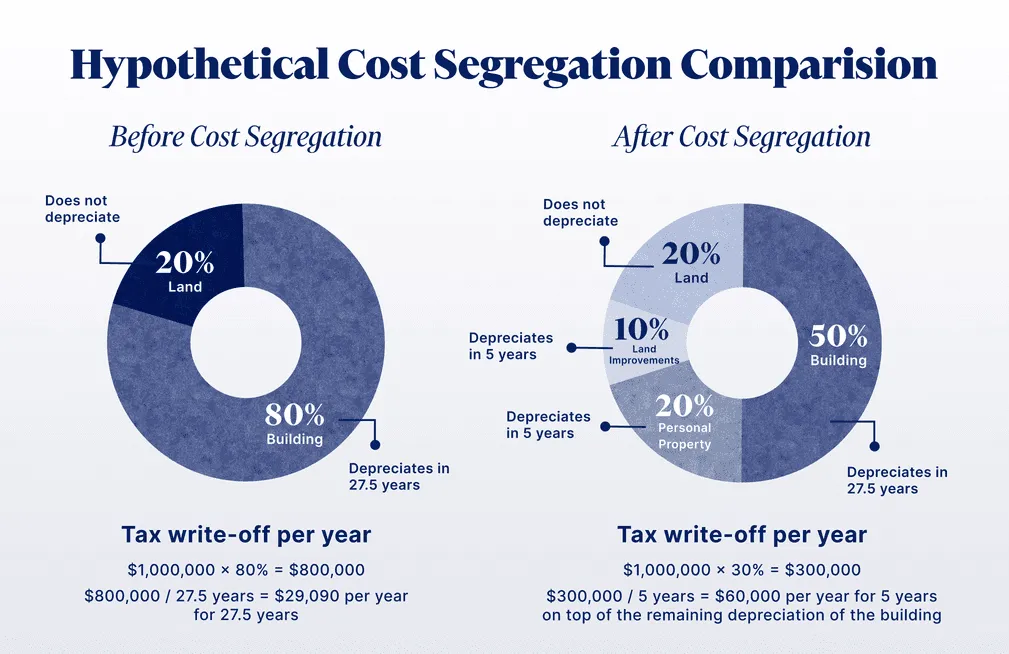

Cost Segregation

Cost segregation is a strategic tax planning tool, recognized by the IRS, that allows owners of real estate (both commercial and residential rental property) to accelerate depreciation deductions on certain components of their buildings.

How it works:

Instead of depreciating the entire building over the standard 39 years (for non-residential) or 27.5 years (for residential), a cost segregation study dissects the property into various components.

This study identifies assets within the building that qualify for shorter depreciation periods (typically 5, 7, or 15 years).

Examples of such components include plumbing and electrical fixtures, carpets, lighting, specialized equipment, and land improvements like sidewalks and fencing.

By reclassifying these assets, property owners can accelerate depreciation deductions, resulting in significant tax savings and increased cash flow.

Financial protection

Helps bridge the gap created by a decline in sales, productivity, and revenue due to the loss of a key individual.

Business continuity

Provides a financial cushion to cover the costs of finding, recruiting, and training a replacement, minimizing disruption and ensuring smooth operations.

Debt repayment

Funds can be used to settle outstanding business loans and debts for which the key person was responsible.

Investor confidence

Demonstrates a proactive approach to risk management, reassuring investors and stakeholders of the business's stability.

Employee Morale

Can indirectly benefit employees by assuring job security and demonstrating the company's commitment to protecting its key assets.

Tax-Free Death Benefits

Death benefits received by the business are typically tax-free, provided certain IRS requirements, such as written notice and employee consent, are met.

IRS Compliant

Adhering to all tax laws and regulations established by the Internal Revenue Service (IRS).

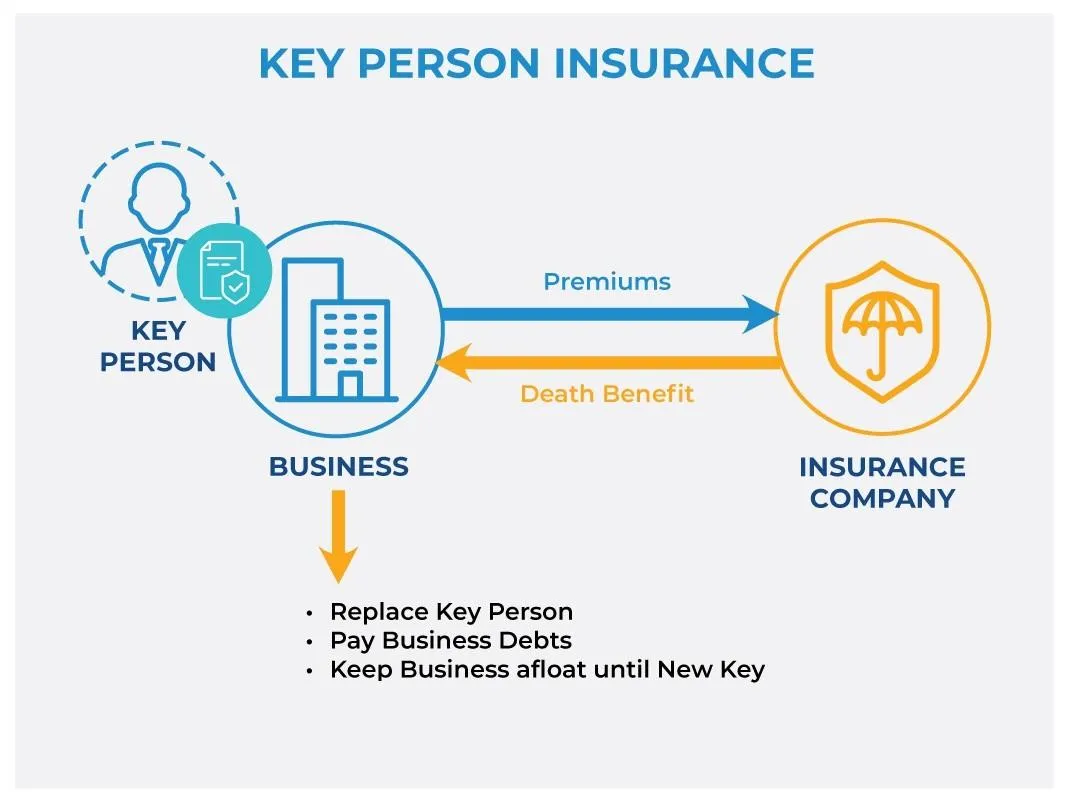

Key Person Protection

Keyman insurance, also known as key person insurance or key employee insurance, is a special type of insurance that protects businesses from the financial repercussions of losing an owner, executive, or other crucial employee due to death or critical illness.

What makes someone a "key person?"

A key person is an individual whose unique skills, knowledge, relationships, or contribution to the business are indispensable, making their absence potentially devastating to the company's financial stability and operational continuity. This can include founders, top executives, specialized engineers, high-performing salespeople, or anyone responsible for a significant portion of the company's revenue or client relationships.

How does it work?

Policy Ownership: The business purchases the policy, pays the premiums, and is the sole beneficiary.

Employee Consent: The insured employee must provide written consent for the company to take out the policy.

Death Benefit: In the event of the key person's death, the business receives the death benefit, which can be used to cover various expenses and maintain operations.

Disability Coverage: Keyman insurance can also be structured to include disability coverage, providing benefits if the key person becomes disabled and unable to work.

Improved Cash Flow

Premium financing allows individuals and businesses to spread premium payments over a specified period, typically in installments rather than a large upfront payment, which eases the strain on cash flow.

This approach frees up capital that would otherwise be tied up in insurance premiums, allowing individuals and businesses to use these funds for other investments or operational needs.

Flexible payment structures can align with income cycles or revenue patterns, offering better financial planning and predictability.

Access to higher coverage limits

Premium financing can make higher-value insurance policies more accessible, allowing individuals and businesses to secure the coverage they truly need without being limited by the upfront premium cost.

This means individuals can get robust coverage for their estates or personal assets, and businesses can obtain higher liability limits or specialized policies to manage risks more effectively.

Estate planning and wealth preservation

Premium financing, especially for life insurance, can be a key component of estate planning strategies, allowing individuals to acquire substantial life insurance coverage without liquidating other assets.

Life insurance policies funded through premium financing can help individuals minimize estate taxes by providing tax-free liquidity to cover these taxes and other debts upon their passing.

This approach can help protect heirs from the burden of having to sell assets to cover taxes or debts after death.

Preservation of investment Strategies

By financing insurance premiums, individuals and businesses can avoid disrupting their investment portfolios or liquidating assets to pay for insurance coverage.

This allows assets to remain invested and continue growing, supporting long-term financial goals and wealth-building potential.

Potential tax advantages

In some cases, the interest on premium financing loans may be tax-deductible, potentially offering an additional financial advantage, though this depends on specific circumstances and local laws.

Consulting with a tax professional is crucial to determine eligibility and understand the implications.

Tax benefits can also arise from the structure of the financing, such as minimizing gift taxes when transferring wealth through life insurance held in a trust.

Business continuity and executive benefits

Businesses can use premium financing for key person insurance, which provides financial protection if a vital employee or executive passes away.

Financing these policies helps ensure business continuity and stability during challenging times, without straining cash flow.

Premium financing can also support executive benefit packages, helping companies attract and retain top talent without impacting immediate cash flow.

Increased wealth transfer potential

Premium financing can facilitate securing larger life insurance policies, leading to a more substantial death benefit that can be passed on to heirs or charitable organizations.

This can amplify the ability to transfer wealth and create a lasting legacy for future generations or philanthropic causes.

IRS Compliant

Adhering to all tax laws and regulations established by the Internal Revenue Service (IRS).

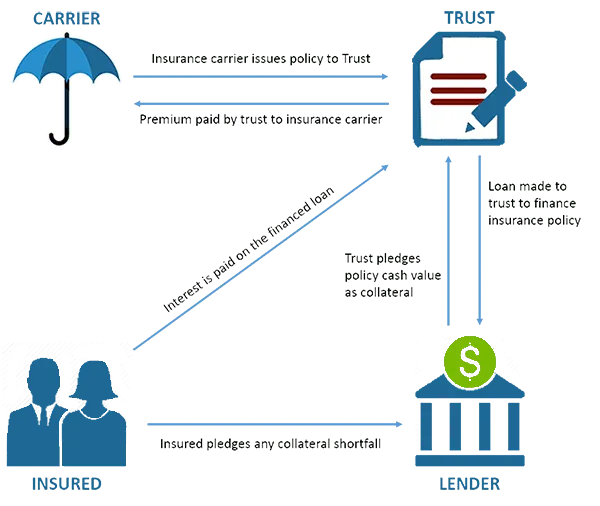

Premium Finance (Leveraging Strategy)

Premium financing offers a way to manage the costs of insurance premiums, especially for individuals or businesses needing high-value policies, by allowing them to pay over time instead of a lump sum upfront. This strategy helps preserve liquidity and provides other benefits, particularly for high-net-worth individuals and businesses.

THE BENEFIT

Learn how to double and often triple your retirement income by leveraging bank loans to make your Life Insurance Premium Payment which results in a much higher tax-free income then most traditional methods can produce like a 401k, standard life policy, real estate.

How does it work?

Here's how it generally works:

Loan agreement: The policyholder enters into a loan agreement with a premium finance company or other third-party lender.

Premium payment:

The lender pays the insurance premium directly to the insurance company.

Loan repayment: The policyholder repays the loan to the lender, typically in monthly or quarterly installments, often with interest.

High Contribution Limits

Cash balance plans allow for significantly larger tax-deductible contributions compared to 401(k)s, making them attractive for high-income earners and business owners looking to maximize retirement savings and reduce tax liability.

Tax Benefits

Contributions are tax-deductible for the business and taxes are deferred for the participant until withdrawal. Some businesses may also qualify for the qualified business income (QBI) deduction through cash balance plan contributions.

Predictable Benefits

Participants receive a guaranteed interest rate credit, providing more predictable retirement benefits compared to plans where returns are tied directly to market performance.

Flexibility and Customization

Employers have some flexibility in designing the plan, including setting contribution levels and determining who is covered, subject to non-discrimination rules.

Portability

Vested benefits are portable and can be rolled over to an IRA or another qualified retirement plan upon termination of employment.

Federal Insurance

Like most traditional defined benefit plans, cash balance plans are often insured by the Pension Benefit Guaranty Corporation (PBGC), providing an added layer of security for participants.

Disadvantages

Complexity and Cost: Cash balance plans are generally more complex and expensive to administer than 401(k) plans, often requiring the services of a third-party administrator (TPA) and actuarial certifications.

Permanence: These plans are designed to be permanent, typically requiring a commitment to funding for at least five years, unless there's a valid business reason for termination.

Minimum Funding Requirements: Employers are subject to minimum funding requirements under the Internal Revenue Code, requiring contributions even in years the business might prefer not to contribute as much.

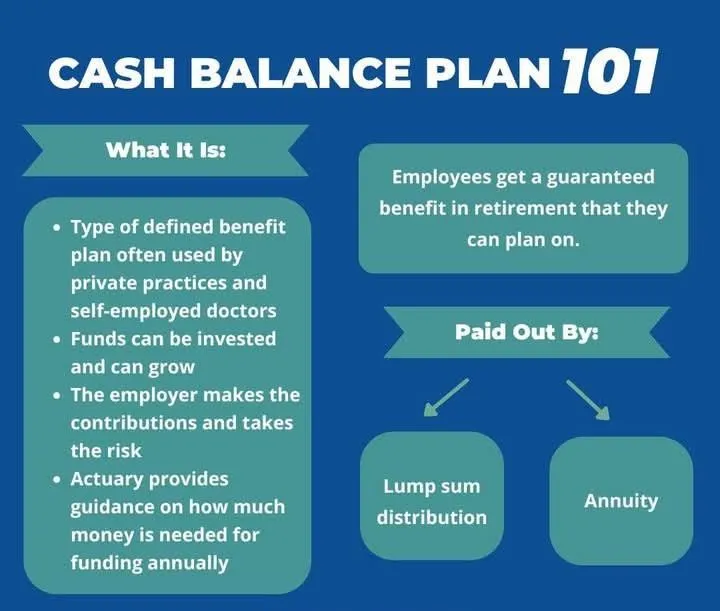

Cash Balance Plan

A cash balance plan is a specific type of retirement plan that combines characteristics of both defined benefit and defined contribution plans, making it a "hybrid" plan. While it technically falls under the category of a defined benefit plan, it distinguishes itself by defining the promised retirement benefit in terms of a stated account balance, similar to a defined contribution plan like a 401(k).

How does it work?

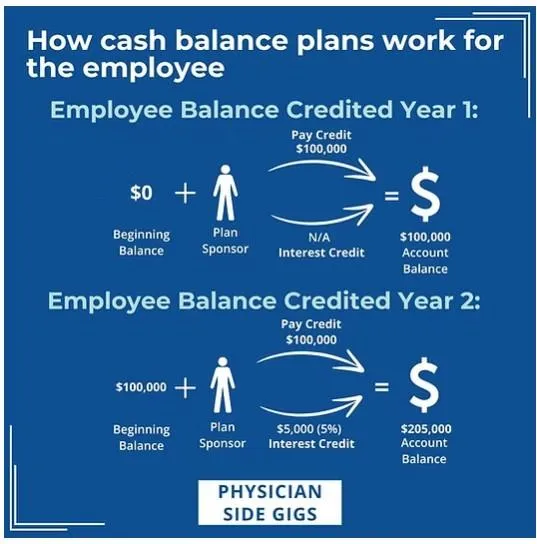

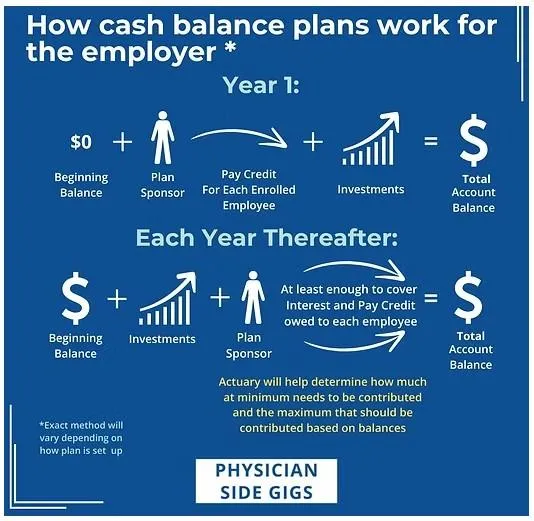

Hypothetical accounts:

Each participant in a cash balance plan has a hypothetical account that is credited with a certain amount each year, based on a formula defined in the plan document.

Pay Credits:

These are usually a percentage of the participant's compensation or a fixed dollar amount contributed by the employer.

Interest Credits:

The hypothetical accounts also receive annual interest credits. This rate can be fixed (e.g., 5%) or variable, often linked to a market index like the 30-year Treasury yield or the actual return on plan assets.

Employer Bears Risk:

A key difference from 401(k) plans is that the employer, not the employee, bears the investment risk in a cash balance plan. The employer is responsible for ensuring the promised benefits are paid, regardless of the plan's investment performance.

Benefits:

At retirement or termination of employment, participants can typically receive their vested benefit as a lump sum or convert it into a lifetime annuity.

In essence, cash balance plans offer a powerful tool for businesses, especially smaller ones and professional service firms, to provide substantial retirement benefits to their employees, particularly owners and executives, while potentially achieving significant tax advantages.

© Business Tax Mitigation