Contact Us

Estate Taxes

Understanding the Basics: Inheritance Tax vs. Estate Tax

Estate tax and inheritance tax are often confused because both apply after someone’s death, but each is distinct and requires different planning strategies.

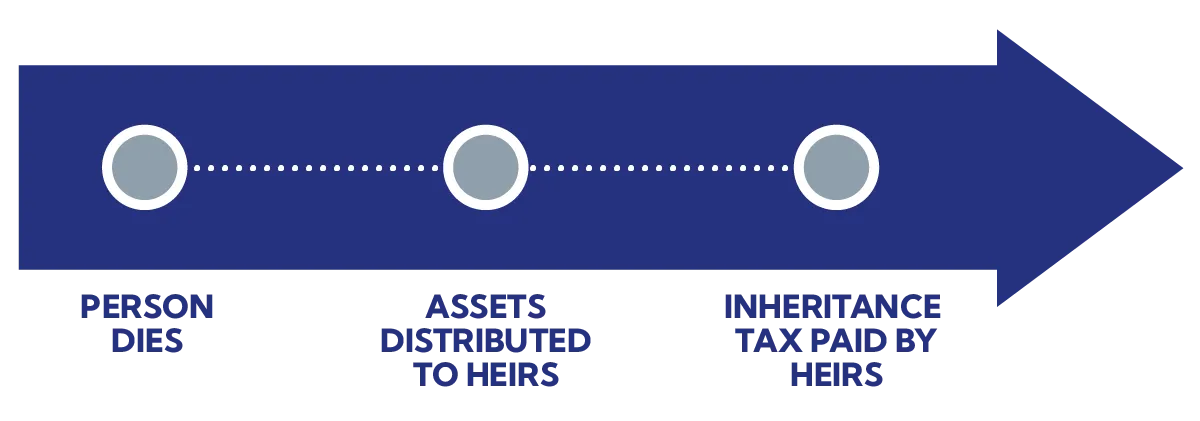

Inheritance Tax Overview

An inheritance tax is a tax assessed on the value of property inherited by the heir of a decedent. The tax is paid by the surviving heir after assets are distributed from the decedent’s estate.

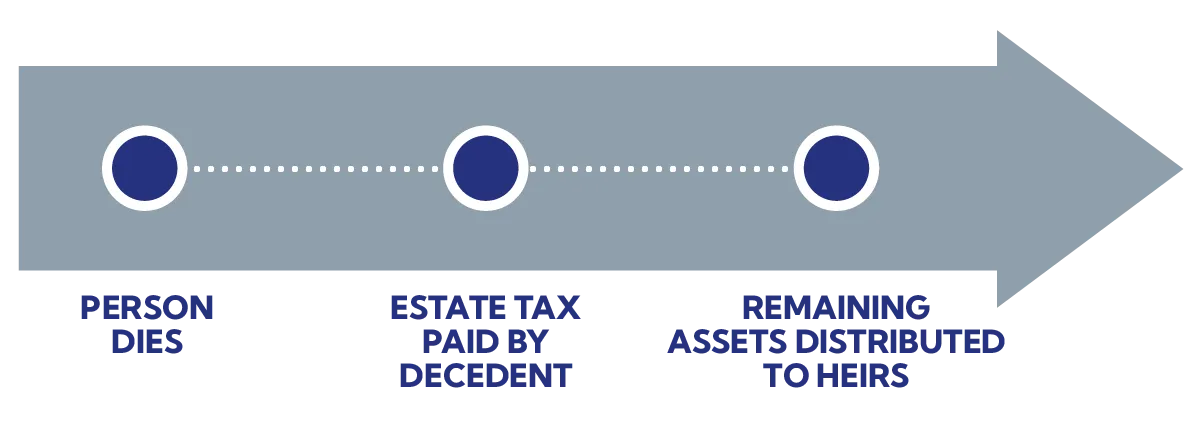

Estate Tax Overview

An estate tax, as defined by the IRS, is a tax on your right to transfer property at your death. Unlike an inheritance tax, which is paid by the surviving heirs, an estate tax is assessed on the value of the decedent’s estate before being passed down to heirs.

Why the Distinction Matters

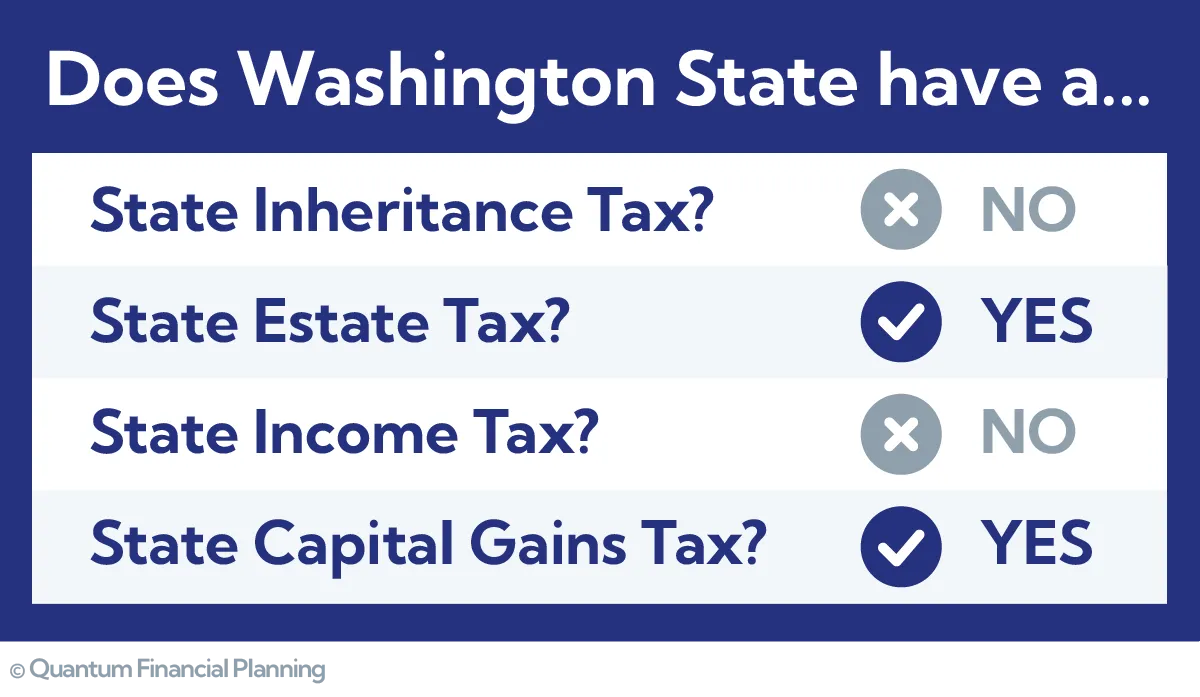

While this differentiation may seem minor, it’s important to clarify. Essentially, the difference comes down to two things: when and on whom the tax is assessed.

Inheritance taxes are rare, as there is no federal inheritance tax and only five states impose a state-level inheritance tax as of 2025. There is, however, a federal estate tax, though it affects only a select number of households due to the high exemption amount. Additionally, 12 states impose a state estate tax.

If you have a taxable estate, understanding which tax applies to your situation can guide you in your estate planning and help you minimize the amount of your money that goes to your state’s department of revenue when you pass.

Example of Washington State

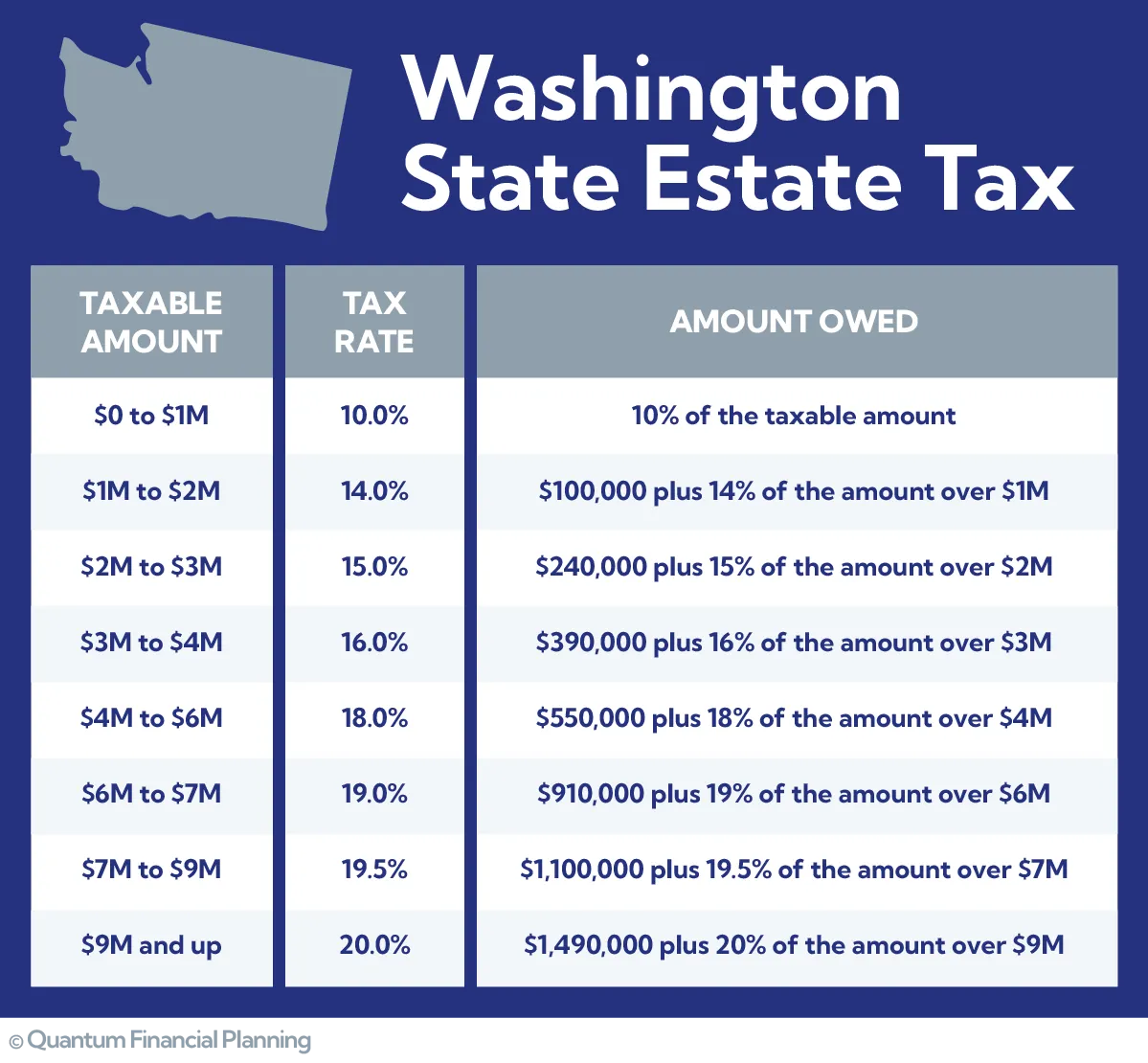

Washington State has a $3 million exemption...

The chart below is what happens AFTER that exemption is applied.

© Business Tax Mitigation